Navigating insurance coverage for drug rehab can feel like a daunting task, but it doesn’t have to be. With the right knowledge and resources, you can make informed decisions about your treatment options and ensure you’re getting the best care possible. This blog post offers a fresh perspective on understanding insurance plans, public insurance options, alternative funding methods, and legal protections related to addiction treatment. By the end, you’ll be well-equipped to confidently choose the right rehab facility for your needs.

Key Takeaways

- Understand your insurance plan’s coverage for rehab services, including substance abuse disorder benefits and ACA essential health benefits.

- Consider options such as private insurance, public programs (Medicare/Medicaid), sliding scale fees & payment plans, grants & scholarships when selecting the right rehab facility.

- Utilize SAMHSA treatment locator tool to locate facilities that accept your insurance. American Addiction Centers also provide comprehensive care with various accepted insurances.

Understanding Your Insurance Plan’s Rehab Coverage

Insurance coverage for drug and alcohol rehab is now more common than ever, thanks to legal mandates and increased awareness about the importance of addiction treatment. However, understanding the specifics of your insurance plan can be overwhelming.

We will delve into the diverse facets of insurance plans for rehab coverage, including:

- Substance abuse disorder benefits

- The difference between in-network and out-of-network care

- The essential health benefits provided by the Affordable Care Act (ACA)

Deciphering Substance Abuse Disorder Benefits

Substance Use Disorders (SUD) affect millions of Americans. Health insurance providers typically cover the cost of rehab treatment for drug or alcohol addiction, which can include a variety of addiction types such as:

- alcohol

- suboxone

- heroin

- cocaine

- meth

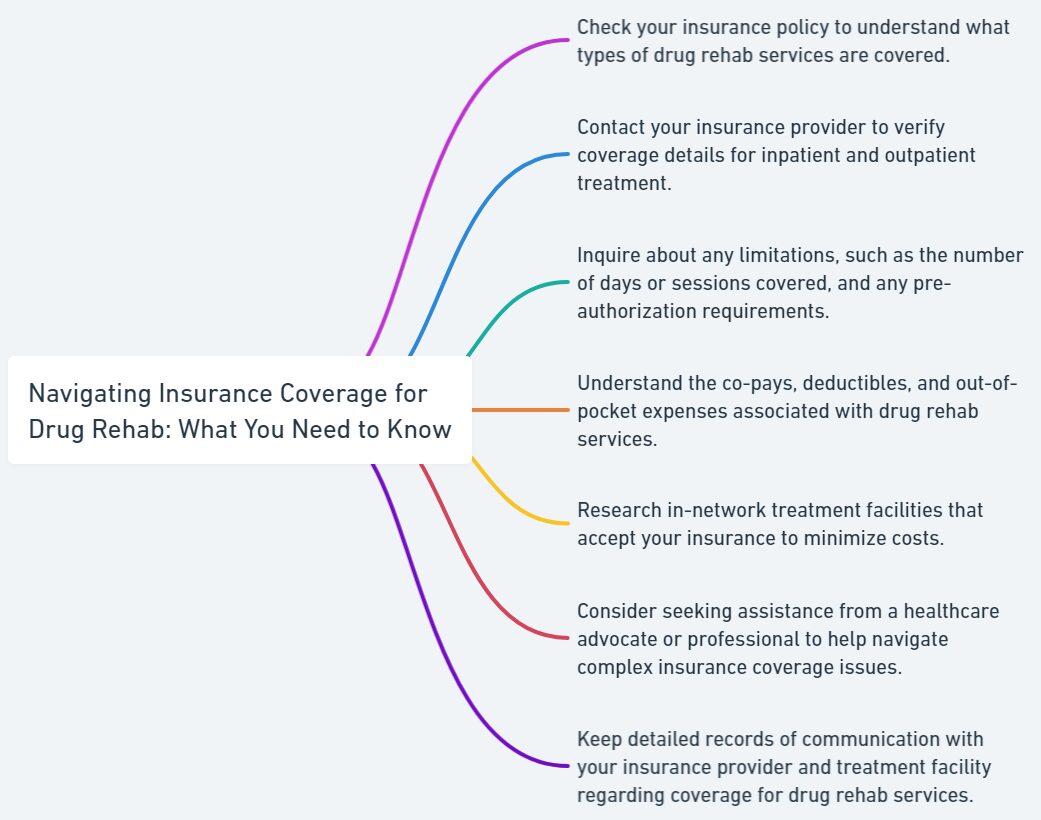

However, the extent of coverage may vary depending on your specific insurance plan and the nature of the treatment services at the drug rehab like Lantana Recovery. Comprehending the benefits offered by your insurance plan is vital as it aids in making informed decisions about your addiction treatment options.

In addition to covering various types of substance addiction, many insurance providers also accept a wide range of rehab facilities for treatment. A review of your insurance plan’s substance abuse disorder benefits enables determination of the covered facilities and treatment services, guaranteeing that you obtain suitable care for your situation.

In-Network vs. Out-of-Network Care

In the context of rehab coverage, it’s important to distinguish between in-network and out-of-network care. In-network providers have an agreement with your insurance carrier to provide services at a predetermined price, whereas out-of-network providers do not. Utilizing an in-network facility while using health insurance is likely to result in reduced out-of-pocket expenses.

However, if an in-network provider is not available or if you prefer an out-of-network facility, it may be possible to arrange a payment plan with the facility to facilitate reimbursement of the treatment cost over time. While this may result in higher out-of-pocket costs, it provides flexibility in choosing the best treatment facility for your needs.

Essential Health Benefits Under the ACA

The Affordable Care Act (ACA) has had a significant impact on insurance coverage for addiction treatment. It mandates that insurance companies provide coverage for certain types of drug and alcohol rehab as an “essential health benefit” (EHB). This means that addiction treatment must be covered by plans in the Health Insurance Marketplace to the same extent as other medical conditions.

However, the specific substance abuse treatments covered by insurance plans under the ACA may vary. Some health plans provide coverage only for certain services. For instance, they may cover drug or alcohol detox and outpatient treatments but not inpatient programs. A thorough review of your insurance plan’s essential health benefits and consultation with your insurance provider is vital to ensure you obtain the suitable coverage for your addiction treatment needs.

The Role of Private Insurance in Rehab Treatment

Private insurance plays a significant role in rehab treatment, offering the most options for those seeking alcohol or drug rehab insurance coverage. However, private insurance is typically the most expensive option and is not subsidized by the government.

We will investigate the role of private insurance in rehab treatment, encompassing the various types of health insurance plans and the process of contacting insurance providers for coverage details.

Evaluating Different Types of Health Insurance Plans

There are several types of health insurance plans available, such as:

- Health Maintenance Organizations (HMOs): These plans typically provide coverage for a wide range of services but require the use of in-network providers.

- Preferred Provider Organizations (PPOs): These plans offer more flexibility in terms of provider choice but may incur higher out-of-pocket costs.

- Exclusive Provider Organizations (EPOs): These plans require the use of in-network providers and do not provide coverage for out-of-network services.

- Point of Service (POS) plans: These plans allow members to choose between in-network and out-of-network providers, but may require a referral from a primary care physician for certain services.

While considering private insurance for rehab coverage, evaluating the diverse types of health insurance plans and their addiction treatment coverage is crucial. Understanding the nuances of each plan type will enable you to make an informed decision about which plan best suits your needs and financial capabilities.

Contacting Your Insurance Provider Directly

One of the most effective ways to obtain information regarding your insurance coverage for addiction treatment is to contact your insurance provider directly. Inquiry about your plan’s coverage for rehab services, including any applicable copays, deductibles, and limitations, guarantees that you receive suitable care and circumvent unexpected costs.

Additionally, the Substance Abuse and Mental Health Services Administration (SAMHSA) Treatment Locator Tool can be used to identify which rehab facilities accept your insurance. This tool provides an invaluable resource for finding appropriate care while considering your insurance coverage.

Public Insurance Options for Addiction Treatment

For those without private insurance or with limited coverage, public insurance options like Medicare and Medicaid can make rehab more affordable. These public insurance programs provide coverage for various addiction treatment services, including:

- Detoxification

- Inpatient rehabilitation

- Outpatient counseling

- Medication-assisted treatment

We will delve into the public insurance choices for addiction treatment, with a focus on Medicare and Medicaid coverage.

Medicare’s Coverage for Substance Abuse Treatment

Medicare is a federal health insurance program that provides coverage for substance abuse treatments in both inpatient and outpatient settings, including alcohol misuse screenings, counseling, and prescription medications for substance abuse and alcohol withdrawal. However, deductibles, copayments, and coinsurance may apply.

Comprehending the extent of Medicare’s coverage for addiction treatment aids in making informed decisions about your care and guarantees that you receive the suitable services for your needs.

Medicaid Eligibility and Rehab Services

Medicaid is a public health insurance program that provides coverage to low-income families. Eligibility for addiction treatment coverage through Medicaid is typically determined by income and family size. However, not all facilities accept Medicaid as a form of payment, so it’s important to research and contact potential treatment facilities to determine if they accept Medicaid.

In states that have expanded Medicaid under the Affordable Care Act, individuals whose incomes are below 138% of the Federal Poverty Level may be eligible for coverage, which is equivalent to $16,243 per year for an individual. Consult with your state’s Medicaid program for specific income eligibility criteria and available addiction treatment services.

If you are soon enrolling in an inpatient rehab and wondering what to take with you, read our complete guide on packing for rehab.

Alternative Funding for Drug Rehab Without Insurance

If you don’t have insurance or your insurance doesn’t cover the full cost of addiction treatment, there are alternative funding options available. These options can help you pay for rehab services and ensure you receive the care you need. We will discuss alternative funding options like:

- Sliding scale fees

- Payment plans

- Grants

- Scholarships for addiction treatment

Sliding Scale Fees and Payment Plans

Sliding scale fees and payment plans offered by rehab facilities can provide a more affordable option for those without insurance coverage. A sliding scale fee is a payment structure where the cost of treatment is adjusted according to an individual’s financial capabilities, allowing people with limited financial resources to access rehab services at a more reasonable rate.

Payment plans are another option that allows individuals to begin treatment promptly without having to pay the full amount upfront. Many rehab facilities provide the option of paying for treatment in installments, making the cost of treatment more accessible for individuals, including those with limited insurance coverage or financial resources.

Seeking Grants and Scholarships for Treatment

Grants and scholarships are available for individuals who need financial assistance to access addiction treatment. These funding options can be provided by government agencies, nonprofit organizations, or even rehab facilities themselves. To apply for grants and scholarships, start by researching available funding options and contacting the relevant organizations or facilities for more information on the application process.

Exploring alternative funding options ensures that you receive the necessary care for your addiction, irrespective of your insurance coverage or financial situation.

Legal Protections and Insurance

There are several legal protections related to insurance and addiction treatment that help ensure you receive appropriate care while maintaining your privacy. We will review two key legal protections: the Health Insurance Portability and Accountability Act (HIPAA) and the Mental Health Parity and Addiction Equity Act. These protections play a significant role in safeguarding your rights and ensuring equal access to addiction treatment services.

HIPAA Badge of Privacy for Your Health Records

The Health Insurance Portability and Accountability Act (HIPAA) is a federal law that establishes national standards for the protection of sensitive patient health information. HIPAA ensures the privacy and confidentiality of your health records, including information related to addiction treatment, by mandating compliance with the Privacy Rule. This rule requires written patient consent for disclosure of information, with certain exceptions such as treatment purposes or emergencies.

Comprehending HIPAA’s role in safeguarding the privacy of your health records during addiction treatment provides assurance that your personal information is protected and disclosed only when necessary.

Mental Health Parity and Addiction Equity Act

The Mental Health Parity and Addiction Equity Act (MHPAEA) is a federal law that ensures equal access to mental health and addiction treatment services. This law mandates that insurance coverage for mental health conditions and substance use disorders be on par with coverage for other medical conditions. This means that insurance plans cannot impose higher copayments, deductibles, or out-of-pocket limits for substance abuse treatment compared to other medical treatments.

Understanding the protections provided by the Mental Health Parity and Addiction Equity Act allows you to ensure your insurance plan provides suitable coverage for addiction treatment, thereby making your recovery journey more accessible and affordable.

Choosing the Right Rehab Facility

Selecting the right rehab facility is a crucial step in your journey towards recovery. With the various options available, it’s essential to consider factors such as insurance coverage, the type of treatment provided, and the facility’s reputation.

We will provide guidance on selecting the right rehab facility and introduce two valuable resources: the Substance Abuse and Mental Health Services Administration (SAMHSA) treatment locator tool and the understanding of insurance acceptance at American Addiction Centers.

If you are wondering if rehab is worth the cost, read our article on drug rehab success statistics where we delve into the tangible outcomes and effectiveness of rehabilitation programs, providing valuable insights that can inform your decision-making process.

Using the SAMHSA Treatment Locator Tool

The Substance Abuse and Mental Health Services Administration (SAMHSA) treatment locator tool is an invaluable resource for finding rehab facilities that accept your insurance. This confidential and anonymous tool allows you to:

- Search for mental illness and substance use disorder treatment services in your area.

- Provide your location and the type of treatment you’re seeking.

- Generate a list of rehab facilities that meet your criteria.

Utilizing the SAMHSA treatment locator tool can save you time and effort in finding the right rehab facility for your needs while considering your insurance coverage.

American Addiction Centers and Insurance Acceptance

American Addiction Centers (AAC) is a nationwide organization that provides comprehensive substance abuse treatment and care at various treatment centers across the United States. They specialize in dual-diagnosis drug and alcohol addiction treatment and offer a full range of services. Many AAC facilities accept insurance coverage from a variety of private insurance companies. The American Addiction Centers logo is a symbol of their commitment to helping individuals overcome substance abuse and alcohol addiction.

Understanding the role of American Addiction Centers in addiction treatment and their acceptance of various insurance plans aids in making an informed decision about the facility that best suits your needs and financial capabilities.

Summary

Navigating insurance coverage for drug rehab can be challenging, but with the right knowledge and resources, you can make informed decisions about your treatment options. By understanding your insurance plan’s rehab coverage, exploring public and private insurance options, seeking alternative funding methods, and being aware of legal protections, you can ensure you receive the care you need while maintaining your privacy. Remember, the journey to recovery begins with a single step – and that step starts with understanding your options and choosing the right rehab facility for your needs.

Frequently Asked Questions

Can you get life insurance if you are a recovering addict?

You must be sober for at least two to three years before most life insurance companies will consider you eligible for coverage, and even then you will likely pay more in premiums than someone without a history of addiction.

What types of insurance plans typically cover drug rehab treatment?

Health insurance plans, such as HMOs and PPOs, generally provide coverage for drug rehab treatment, either in full or partially. Coverage amounts vary depending on the specific plan and provider.

Are there public insurance options available for addiction treatment?

Yes, public insurance options such as Medicare and Medicaid provide coverage for addiction treatment services, including detoxification, inpatient rehabilitation, outpatient counseling, and medication-assisted treatment.

What alternative funding options are available for drug rehab without insurance?

Alternative funding options for drug rehab without insurance include sliding scale fees, payment plans, grants, and scholarships, providing access to treatment even if there is no insurance coverage.

What legal protections are in place to ensure the privacy of my health records during addiction treatment?

Legal protections, such as the Health Insurance Portability and Accountability Act (HIPAA) and the Mental Health Parity and Addiction Equity Act, are in place to ensure your health records remain private during addiction treatment.